Where luxury, NFTs, and Bitcoin meet

The major goal of every business is to make a profit and add value to customers. Jewelry brands can achieve these two things by integrating fashion with quality and modern technology. The crypto space offers luxurious jewelry brands a better platform for this integration via tokenization. It gives brands access to special pricing methods, to be represented on the blockchain with limited edition and assigned redeemable tokens.

As the world moves toward tokenization, various platforms are taking steps to the next level by adding value to real-world assets such as jewelry and precious metals. DESIRED is one such platform that has created an exquisite collection of Bitcoin-inspired gold rings called Diamond Hands. Every piece of this ring is assigned a utility token, In Bitcoin We Trust, IBWT. The company took a step further to restore the value and trust in the jewelry industry using a special pricing method known as the bonding curve.

How Can Jewelry Brands Benefit From Special Pricing Methods?

Diamond Hands was created to overcome the problem of poor quality jewelry designed from machines and mass production. Its special pricing method can be adopted by other luxurious jewelry brands. This backs up the company’s philosophy that every piece of jewelry holds greater significance than an ornament and must be unique and pure.

The pricing method alters the market forces that enable price to be controlled by the demand. In this case, supply determines price such that price goes higher as supply increases. Price increases by 6 percent each time a purchase is made.

The bonding curve pricing method states that if you buy tokens when the supply is low, you will pay much less than when the supply is high. If you buy when there are already a lot of tokens in circulation you will pay much higher than you paid when the supply was low.

Brands can benefit in various ways when they adopt the bonding curve price mechanism.

Customer Experience

The bonding curve sales approach is to reward early adopters. It functions like a first come first serve system, early adopters stand a chance to earn more profit since prices increase after every purchase. The more purchases made, the more they earn on their investment.

Diamond Hands does not sell rings according to a fixed price. The bonding curve determines its supply function such that every time a ring is bought, the token’s price increases by 6 percent. Prices increase as the number of distributed tokens increases, and early adopters can make more gains.

Luxurious brands can attract more customers when they adopt this pricing mechanism and increase sales volume.

Taking Advantage of Exclusive Edition

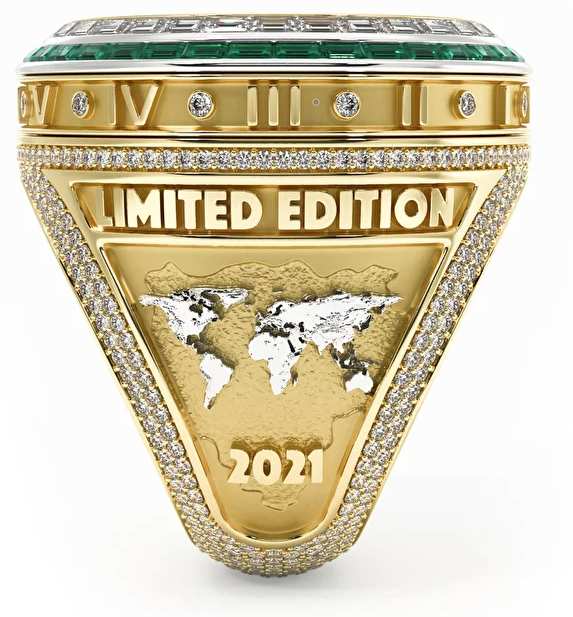

Diamond Limited Edition Ring

Having a luxurious jewelry brand represented on the blockchain with a limited edition creates an opportunity for brands to control quality. It proves uniqueness and differentiates the original from mass production.

Diamond Hands rings with the inscription “Limited Edition” indicate the exclusivity of jewelry. In the limited edition, only 100 rings will be handmade. All are 750th gold purity, inlaid with diamonds 3.6 carats and emeralds 1.5 carats. Currently, the brand listed the 01/100 edition ring at Binance NFT marketplace; the token it’s also available at their platform.

Brands can take advantage of the exclusive edition to control quality, price, and supply.

Conclusion

Besides leveraging the crypto space via NFTs, Luxurious Jewelry brands can benefit from using the bonding curve pricing system. They can generate more profits by stirring up the interest of early adopters and increasing the customer base. It also offers them the chance to control supply, offer the best quality jewelry to customers and avoid mass production.